CORE PRODUCT

All successful companies have one thing in common: their financial management is solid as a rock. This used to mean spending hours reconciling payments and tracking down missing invoices.

Today, hotel financial management wears a different face thanks to new technologies that are catching all these mishaps to save accountants time and make manual errors practically obsolete.

Hotel operators can streamline their businesses operations by using a Property Management System (PMS) with integrated payment processing and financial accounting.

This solution consolidates all of these disparate processes into one simple and easy-to-use platform. It helps operators offer a better guest experience, among other advantages.

Here are some reasons why and how utilising a PMS with integrated solutions can benefit your business.

What is automated payment processing?

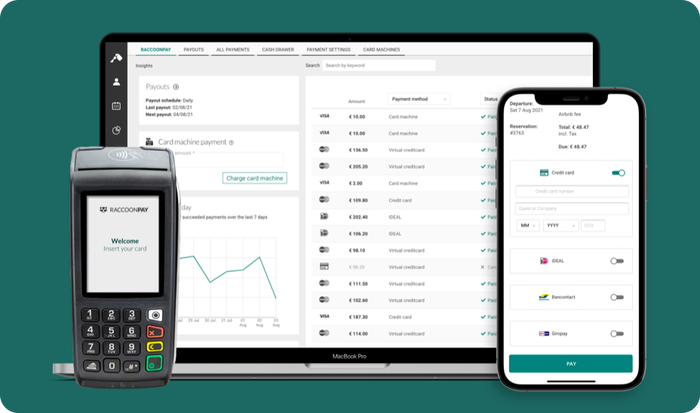

With a payment processing system, payments sync instantly with guest reservations and details are securely stored in the guest profile for future stays. Companies like Stripe, Peach Payments, and PayPal can act as both a payment processor and a payment gateway.

In the hotel industry, technology companies like RoomRaccoon do so as well, helping hotels save costs and bypass the need for a merchant bank account.

What is automated accounting?

With accounting software, all financial data such as invoices are automatically processed and linked to the correct ledger accounts. Hotel businesses use solutions like Xero, Sage, and Quickbooks that can integrate with their PMS.

This way, the PMS automatically sends daily invoices to your bookkeeping system, ensuring that your financial reporting is always up to date and that you can bypass tedious night audits.

Why Should Hotels Merge Automated Payments and Automated Accounting?

1. Time saved

The transfer of financial data within your PMS should happen automatically to free up more of your time. After all, this is the reason you invested in a smart system to manage your property.

For example, you can generate and send invoices at a click of a button, capture online payments from anywhere at any time through the booking engine or booking confirmation, payment request, or onsite with a card machine.

Payments sync instantly with guest reservations. As soon as the full reservation is paid, all sales invoices will be processed to the accounting software.

2. Feel confident in your numbers

How do you measure the success of your hotel’s financial management? Many property operators will say that peace of mind comes from knowing that your numbers are up-to-date and accurate.

As we already said, an integrated accounting system automates routine tasks, leading to zero manual errors, correct data entries and you’ll find greater accuracy in all the calculations.

3. Collect more payments

An integrated payment system opens up more payment channels for hotel operators to collect payments. When your payment system is integrated with your PMS, you have opportunities to collect at every guest interaction point, delivering a more convenient guest experience.

Consider all the guest interaction points at your property. Do you have a front desk for on-site check-in? Guests can make a payment here too with a PMS linked card machine. Do guests visit your website to make bookings? You can embed payment functionality in your website’s booking engine so guests can pay you online.

Does your staff send guests pre-arrival emails regarding payments? They can collect payment right away through a variety of payment methods. Do you distribute your rooms on booking channels?

You can authorise virtual credit cards and collect payment with a click of a button. The result is a more convenient experience for guests and a greater opportunity to collect payments.

4. Higher productivity

The great paradox. Millennials, the largest generation of travelers between 24-39 years of age, demand self-service solutions but also crave true, authentic, and personalised experiences. This is where hotel online check-in lends itself as the perfect middle ground between the two strong preferences.

It’s both a self-service solution, and hotel managers can add the human factor with personalised welcome emails and targeted upsell lists.

6. Better guest experience

It’s no secret that a great guest experience is the key to success, and providing an exceptional experience starts long before guests arrive. Offering online check-in services is one surefire way to meet guest expectations and maintain a flexible business in a hyper volatile industry.

Wrapping up

Online check-in is one of the most sought-after features in hotels. It’s convenient, quick, and best of all? It can be used in clever ways to increase your revenue. If you’re interested in providing this service to your guests, simply book a demo with a local member of our team.

Follow us

Justine. S

Justine is a Content Manager at RoomRaccoon, bringing her background in language and communication studies to the SaaS world. When she's not writing about the latest trends in the industry, she's probably out exploring the world or indulging her love of pink.

Related Posts

Subscribe to our newsletter for more on the latest hospitality & RoomRaccoon updates delivered straight to your inbox!